Written by Eamonn J. Houston

Saudi Arabia has charted a new course of economic diversification away from an overdependence on oil and gas in its Vision 2030 road map. Industrial enablers will be key to Saudi Arabia’s success in this endeavor and in heavy industrial terms, they don’t come much bigger than the maritime industry.

Saudi Aramco has joined forces with three maritime industry leaders to form the joint venture International Maritime Industries (IMI) — a name that is poised to flex a lot of industry muscle, and will not only transform the face of rig and shipbuilding in the region, but also globally. This is a story of an economic transformation, the Ras al-Khair based maritime yard, and how the first ever rigs and ships will be constructed and launched in the Kingdom.

In December 2016, on an approximately 12-square kilometer site on the northeast Gulf coast of Saudi Arabia, The Custodian of the Two Holy Mosques King Salman ibn ‘Abd Al-‘Aziz Al Sa’ud laid the cornerstone for the King Salman International Complex for Maritime Industries and Services.

In October 2017, dredging began at the maritime complex, signaling the start of construction of the anchor tenant, International Maritime Industries (IMI), unlocking one of the master keys for economic potential as outlined in the Kingdom’s Vision 2030 plan.

A New Economic Trajectory

The mega-project heralds the positioning of the Kingdom on a new economic trajectory. The projected macroeconomic impact by 2030 is huge, and the numbers are impressive and support HE Minister of Energy, Industry and Mineral Resources Khalid A. Al-Falih’s statement in December 2016 that the maritime complex would offer a broader palette of development for Saudi Arabia and open the doors for strategic industries to operate and flourish.

It is anticipated that by 2030, 80,000 jobs will have been created, with 30,000 of those direct jobs in the maritime complex. There will be an import substitution of a staggering $12 billion and a gross national product (GDP) impact of $17 billion. In short, it’s good news for the Kingdom.

The Strength of Four Industry Leaders

IMI is a joint venture (JV) between Saudi Aramco, Dubai-based rig building giant Lamprell plc, the Saudi national shipping company Bahri, and Hyundai Heavy Industries (HHI) in South Korea — the world’s largest shipbuilder and owner of the world’s largest shipyard in Ulsan.

IMI has at its center four pillars — the strength of the four partners and how their expertise drives efficiency; supply chain localization through strategic sourcing; stakeholder life cycle partnering; and leading-edge technology. These strengths are unique to IMI and enable it to be well positioned to meet and exceed customer expectations.

Localization of The Supply Chain

When completed in 2022, IMI will be the largest fully integrated maritime yard in the Middle East and North Africa region, and one of the largest maritime yards in the world. It will offer to market new build as well as maintenance, repair and overhaul services for jackup rigs, commercial vessels, and offshore support vessels. This scope of product offering will spur the localization of the supply chain, creating small- and medium-sized enterprise activity.

IMI will deploy the latest technological innovations to deliver a competitive advantage, including Big Data analytics, virtual reality, additive manufacturing, process automation, and a diverse range of robotics and software integration. Its location at Ras al-Khair is geographically strategic, within easy reach of customers to the east and the west and close to international trade routes.

Its annual shipbuilding capacity will be three very large crude carriers, and starting in 2021, IMI will have the capacity to build and launch a minimum of four rigs per year. The annual maintenance, repair, and overhaul (MRO) capacity is 15 rigs, 137 vessels, and 116 offshore support vessels.

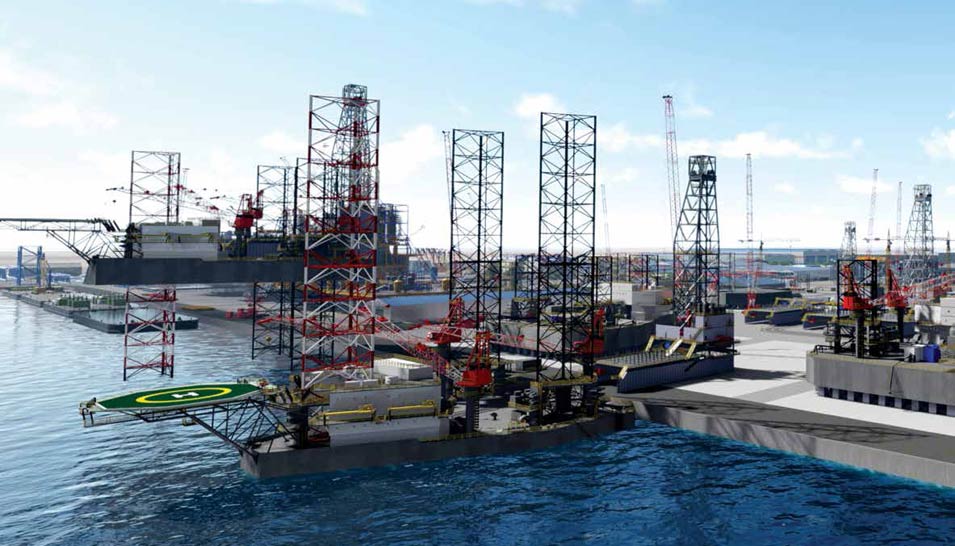

A digital rendering shows how the Ras al-Khair shipyard will look when completed. Both rigs and ships will be constructed, and the shipyard will boast the biggest dry dock and longest quayside in the region. The state-of-the-art complex will be globally competitive in rig and shipbuilding.

Long-term Opportunity

For Saudi Aramco, IMI offers a strategic long-term opportunity — for the first time in the company’s history its offshore requirements can be met in-Kingdom by a company in which it is the majority shareholder.

At its base in the Al Turki building in al-Khobar, IMI is a hive of activity with Saudis, Koreans, Europeans, and other nationalities piecing together a solid structure for the ambitious project. It is here that the technical, marketing, and human resources teams meet to work toward the first rigs and ships to be built in the Kingdom. There’s a huge sense of pride and duty about the task ahead.

And young Saudis are playing their part and gaining invaluable exposure and contributing to the success of a project that holds the weight of history.

Fathi K. Al-Saleem

IMI CEO, Saudi Aramco’s Fathi K. Al-Saleem, sits at the helm of the JV and recalls the genesis of the project.

“Around four years ago,” he says, “we undertook an initiative to identify the opportunities that lend themselves to be obvious for Saudi Aramco to take in terms of strategically integrating its footprint in the Kingdom and helping to diversify the economy and create jobs.”

The initiative that followed was the development of a competitive Saudi energy cluster, which involved a detailed mapping of Saudi Aramco’s activities and the identification of those that appeared to be high priority, big value, and the maritime business presented itself as one obvious opportunity that ticked all of these boxes.

“All of that is based on the huge offshore oil and gas activities for Saudi Aramco, and at the same time, the requirements for shipping, either crude or commercial materials that would require rigs and ships,” says Al-Saleem.

“And then there is our proximity to the international shipping routes. If you put all of this together with the strategic geographic location and the huge offshore oil and gas activities, you can clearly see the benefits and the opportunities — not only for Saudi Aramco, but also for the whole of the Gulf region.”

The next level of analysis involved identifying how IMI could be made a reality and the enablers required to bring this industry anchor together had to be determined.

And so began a complex process with multiple dimensions. Government infrastructure incentives needed to be put in place similar to the arrangements put in place for maritime yards in South Korea and Japan.

Financing was pursued from the Saudi Industrial Development Fund, and the identification of human resources requirements and challenges came next.

“Last, but by no means least,” Al-Saleem says, “we had to work with someone who can actually manage industrial cities, and for us that was obviously the Royal Commission. You cannot manage a sustainable industry when you just have a maritime yard. You really need to have the supply chain and ecosystem encompassing the yard to support production.

“All of the enablers are now in place and we look forward to commencing operations.”

The IMI board of directors met late last year to appoint people to key roles.

Front (from left) are Nabeel A. Al-Jama’, Saudi Aramco vice president of Human Resources; Ali A. Alharbi, Bahri chief financial officer; Abdallah I. Al Saadan, chairman of the board and Saudi Aramco senior vice president of Finance, Strategy and Development; Christopher McDonald, Lamprell plc CEO; and Tae-young Si, Dubai Hyundai Heavy Industries general manager/head.

Back row (from left) are Hani Mohammed, International Maritime Industries (IMI) chief financial officer; Abdul Hameed A. Al-Rushaid, Saudi Aramco executive director of Drilling and Workover; Abdulhakim A. Al-Gouhi, Saudi Aramco vice president of Industrial Services; Tony Wright, Lamprell plc chief financial officer; Ziad T. Al-Murshed, Saudi Aramco executive director of New Business Development; and Fathi K. Al-Saleem, IMI CEO.

(Photos: Yara Ziyad/MPD)

Competitive Advantage

Critical to the success of the IMI JV was persuading the right partners, with the proper know-how and technical expertise, to make this yard a world-class proposition with a distinct competitive advantage.

HHI are the well-established champions of shipbuilding, while Lamprell plc has distinguished itself as a top-class builder and maintainer of offshore jackup rigs. Bahri is Saudi Arabia’s champion of shipping, overseeing a huge fleet. Saudi Aramco brings an impressive range of expertise in terms of project management, HR , eng i neerin g , and bu s in es s development. The company has overseen many of the Kingdom’s signature catalytic energy projects and its contributions are central to developing a vibrant local economy that both trains and employs young Saudis in line with the Kingdom’s Vision 2030.

The combined power of the four partners was becoming a reality and IMI began taking shape.

Al-Saleem points to the technical excellence of IMI.

“From the technical side, the maritime yard is unique in the world as a result of the diversity of products and services we offer. This ranges from offering new builds for jackup rigs and ships to offshore support vessels.

“We also provide MRO services for all of these products. There is not a maritime yard in the region that has this diversity. On another dimension, this maritime yard is designed not only to cater to the requirements of the Kingdom in terms of maritime services and products, but also to the whole region.”

Technical Hub

Mechanical engineer Abdulaziz Al Hejji (left)

and workstream leader Ali K. Al Ajmi at work

at IMI’s al-Khobar base.

(Photo: Yara Ziyad/ MPD)

The goal for IMI is, of course, to become a regional hub and a global competitor. The plan is to leverage the long-term relationship between the JV and its primary customers — namely Saudi Aramco and Bahri.

The strength of these relationships will help to create a strategic supply chain around Ras al-Khair, laying the foundations for a solid platform between strategic suppliers on one side and strategic partners and customers on the other.

“This level of leverage will help IMI be positioned to offer a life cycle, cost-effective product as the long-term collaboration will improve our ability to design projects and redesign and achieve excellence within the life cycle,” Al-Saleem says.

George Gourlay

George Gourlay, chief operating officer of Rig New Build and Rig and Ship MRO, said: “IMI will be the first maritime player to adopt such a strategy.

“The traditional approach is for maritime yards to competitively bid for one or two builds, unlike the continuous relationship on offer at IMI,” he said.

The technical profile of the IMI’s maritime yard is impressive in industrial terms.

Yi Seong Kang, HHI’s chief operating officer of New Ship Build, says the technical muscle will ensure IMI’s competitive edge.

Yi Seong Kang

“The combined 2,150-ton lifting capacity of the Goliath crane will be one of the biggest in the world. It means that we can build vessels with a high level of efficiency.”

HHI also boasts the largest after service network in the world, and IMI will have full access to this network.

For the region, IMI is unique in scale and levels of integration. It will feature the largest dry dock area, one of the largest ship lifts globally at 25,000 metric tons, the longest quayside of 9,000 meters, and the largest total combined area of approximately 12 million square meters.

Supply Chain

Procurement and Supply Chain Management leader Abdullah Al Muhanna was one of the first people on the ground at IMI, tasked with dealing with the maritime project’s strategic supply needs.

Abdullah Al Muhanna

This is a critical function within IMI and crucial to the creation of local content.

“It’s about building the supply chain ecosystem and the vision is to use procurement and supply chain excellence to make IMI a worldclass provider of maritime products and services,” he said.

The strategy is to minimize supply chain and logistical risks, improve margins, and enhance the quality and availability of local supply chains.

The different product and services mix requires different supply chain strategies — responsive and agile for maintenance repair and overhaul, and integrated, planned, and market focused for new building.

The development of a local supply chain ecosystem around the yard will be critical going forward. Local content is a priority, and identifying opportunities for localization is an ongoing process.

Building Training Capabilities

As a new industry, maritime requires specific skill sets and the way to bridge any gap is through a comprehensive human resources and training strategy. This is one of the biggest challenges for IMI, but one that is being methodically approached.

Julian Panter

Julian Panter is charged with establishing the human resources and training function, and staffing.

A lot of work has revolved around essentials such as policy manuals, the compensation and benefits structure, organization structure, and employment agreements. The short-term intent is to have these elements in place.

“There is a long-term intent, which is to really focus on Saudization and how we can place Saudis into this new industry for the Kingdom and the region,” says Panter.

“We look at how we are supporting Vision 2030 through the hiring, development, and retention of Saudi nationals, and in collaboration with the National Maritime Academy, we are developing training plans initially for Saudi high school graduates to grow and develop skills for the trades involved in the maritime industry.”

Saudi Talent

Waleed Al-Othman, Training and Development leader, also underscores the opportunities for young Saudi talent.

“Our target workforce number will be approximately 30,000 employees — direct and indirect — in the complex.

Waleed Al-Othman

According to Al-Othman, IMI has set about maximizing the opportunities contained within Saudi Aramco’s In-Kingdom Total Value Add program.

“We are looking at localizing everything that we do.”

IMI’s scope for education is large. The National Maritime Academy has been set up, and features two training streams — an industrial focused stream, and a more maritime specific stream that focuses on port authority training, navigation, deckhand training, officers, and marine engineering.

Training Centers

The skill sets needed to build and maintain ships will also be a central focus. Saudi Aramco has recently established a Local Workforce Development Department (LWDD) tasked to establish specialized training centers based at the National Industrial Training Institute and Maharat.

The training center closely cooperates with the Technical and Vocational Training Corporation (TVTC), Saudi Aramco, and the College of Excellence.

A training center in Jubail has been availed by the government, and in 2019 a permanent training center will be constructed in Ras al-Khair.

National Maritime Academy

IMI is now the first client of the National Maritime Academy, a nonprofit organization.

Training will be across the full range of skills demanded by the maritime industry.

The concept behind the academy is to provide professional training to skilled Saudi talents with approximately 40 trades offered, including welding, metal fabrication, electrics, and mechanics.

For the maritime yard, there are 150 different job titles — each with a combination of skills, which calls for carefully designed training courses.

The first intake for the two-year program is 700 trainees and there will be 1,000 additional places made available annually. Salaries and medical insurance for trainees will be provided, as well as accommodation for those living outside of a certain geographical area.

Diplomas awarded will be recognized nationally by the TVTC and the College of Excellence, and successful graduates are guaranteed a job.

All of this is being built on IMI’s collective knowledge and it is hoped that this deep mine of experience will result in quicker and better outcomes.

The training model will be unique in that it will combine the best practices of the four JV partners, as well as the industry.

Sa’ad Al-Shahrani

Sa’ad Al-Shahrani is the managing director of the academy and says it is being developed as a best-fit training provider for IMI and the local maritime industry as a whole.

“The whole aspect is about the localizing of jobs, so this could not happen without a training entity for this maritime project. The National Maritime Academy was aligned with the big initiative — the Maritime Yard Joint Venture.

“Saudi Aramco has taken the lead in creating this academy, as it did with so many other academies in the past aimed at creating new opportunities for the local Saudi population.

“This is part of Saudi Aramco’s focus on social responsibility and making sure that all of the enabling elements for the Maritime Yard Joint Venture success are present,” says Al-Shahrani.

Saudi Aramco, along with TVTC, took the lead in establishing the academy by signing a Memorandum of Understanding in late 2016.

The process of getting the center ready is now underway. The academy will not only serve the JV, but will also serve all maritime-related industry within Saudi Arabia. To be specific, the marine operations and the port operations, which by themselves are very large markets. There are tens of thousands of opportunities for young Saudis to be employed in this sector.

Al-Shahrani adds, “For the training itself, we’re looking to partner with top-tier international training providers meeting high expectations of the international JV itself and the local maritime sector. The training provider will also offer the best-inclass training practices to train the Saudis to meet their job requirements and make sure that they are up to the right levels, standards, and up to the challenges demanded by this new company.”

The training provider will have all of the required international and industry mandated qualifications in shipbuilding and marine operations to make Saudi Arabia a hub for such specialized training.

“Attraction and retention is a worldwide challenge in this business, and I think that between the employer itself, which is the JV, and the National Maritime Academy, and the collaborations that they have and the benefits they will be offering to the young Saudis, the state-of-the-art education that they will be benefiting from in this academy, and the bright progression future they have upon graduation, will ensure that we get the proper selection of candidates,” Al-Shahrani says.

Safety First

Peter Snowden is charged with framing IMI’s safety template.

Peter Snowden

“Building on the excellent track records and safety certifications of the four partners, IMI is in a position to have a similar safety performance, procedures and training,” said Snowden.

As well as stakeholder partnering and continuous learning, IMI will deploy cutting-edge virtual reality (VR) technology.

“There are many benefits to the use of VR within our industry. The depth of learning is demonstrably better through ‘doing,’ rather than watching. IMI HSE is investing in VR, as that will bring the benefits of massive reductions in risk to people and assets, reduced costs, and language agnostic training. It is clear that VR is going to be central to the training of the future.”

A Project To Be Proud Of

For Al-Saleem, the coming together of such a complex industrial jigsaw is a source of pride. When fully operational, the maritime complex will play a pivotal role in the Kingdom’s forward economic voyage.

“The whole demography of the industrial landscape within Saudi is going to be transformed. The fact that we have managed to build an anchor project for the Kingdom and to say that we do not just produce oil and gas, but also build rigs and ships, too, and have a regional maritime hub, is an accomplishment we can all be proud of.

“The sense of pride is also coming from seeing young Saudis inspired and working hard to make this happen.

“The day we launch the first Saudi made rig and ship will be a major historical milestone for Saudi Arabia and Saudi Aramco.”

When the King Salman International Complex for Maritime Industries and Services becomes fully operational, it will play a pivotal role in the Kingdom’s forward economic voyage.